Guest Post: Sizing Up Fed Policy From a Rates Trader's Perspective

The usual Opening Print will be published around the same time today.

From Rob, a friend of mine from Discovery Trading Group.

As we wind up the crazy year that was 2022, perhaps the biggest question on all trader’s minds is what will be the expected path of Fed policy action in 2023. With the majority of MrTopStep followers as well as Discovery Trading Group members being short-term index traders, obviously those decisions will have great impact so I thought a refresher on what your first stop should be for speculating what those decisions are likely to be, and perhaps more importantly when they are likely to occur from a rates trader’s perspective.

It shouldn’t be a secret that short-term interest rate forward markets (aka STIRs) are far and away the most liquid and heavily traded derivatives markets in the world. Most index traders are at least aware of the CME Fed Fund Futures markets but in my experience many don’t know exactly what that forward term structure is pricing. Fed Fund futures are priced monthly and are pegged to what the broad market expects the Effective Fed Funds Rate (EFFR) WILL BE at each forward maturity.

What many are confused about is that the EFFR isn’t the Fed target range, but the best overnight free market bank-to-bank lending rate is, and which except in special circumstance will fall between the high and low yield that is the expected Fed Funds target range.

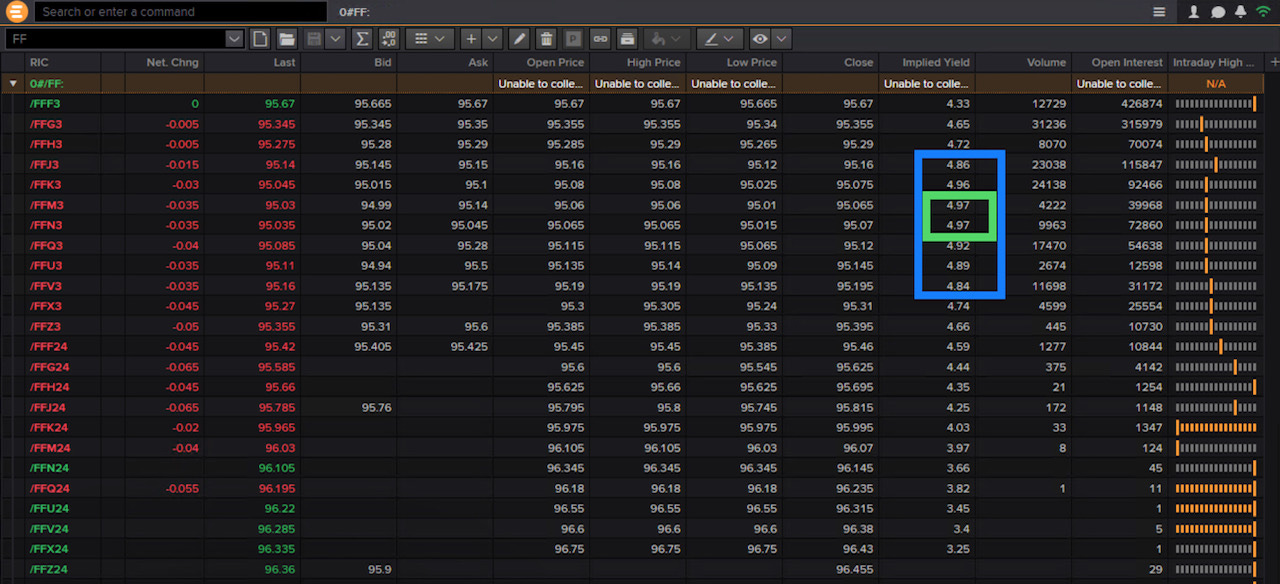

As of this writing, the current target range is 425-450bps and the EFFR today is 433bps. With that knowledge as a baseline, your first stop should always be to look to the Fed Fund Futures term structure to determine what the market believes the terminal rate might be and when it might occur. These markets trade in a price equivalent yield where 100 minus price equals yield.

As you can see in the image below of the term structure, the market currently expects the highest EFFR to fall within a target range of 475-500 as early as April of this year and to fall out of that range as late as November. But also note the highest EFFR is not expected until June/July. Remember that the key word is “expected” here, so the market is fairly confident in the range but less so on the exact timeframe currently. It believes the 475-500 key rate may be reached anywhere in this window, but also believes if reached earlier rather than later will likely stick at that terminal key rate range for several months potentially as well. I can assure you that all rates portfolio hedgers, speculators and market makers are constantly riveted not only to where the term structure is priced currently, but more importantly how it’s changing over time — and you should be too IMHO even if you’re an index trader navigating any policy change cycle up or down.

However, I’d also add that any accomplished trader should also be aware of and closely follow another market often “dark” to retail traders which is constantly pricing the same forward EFFR expectation. Believe it or not, these markets absolutely DWARF the Fed Fund Futures market in both liquidity and notional value.

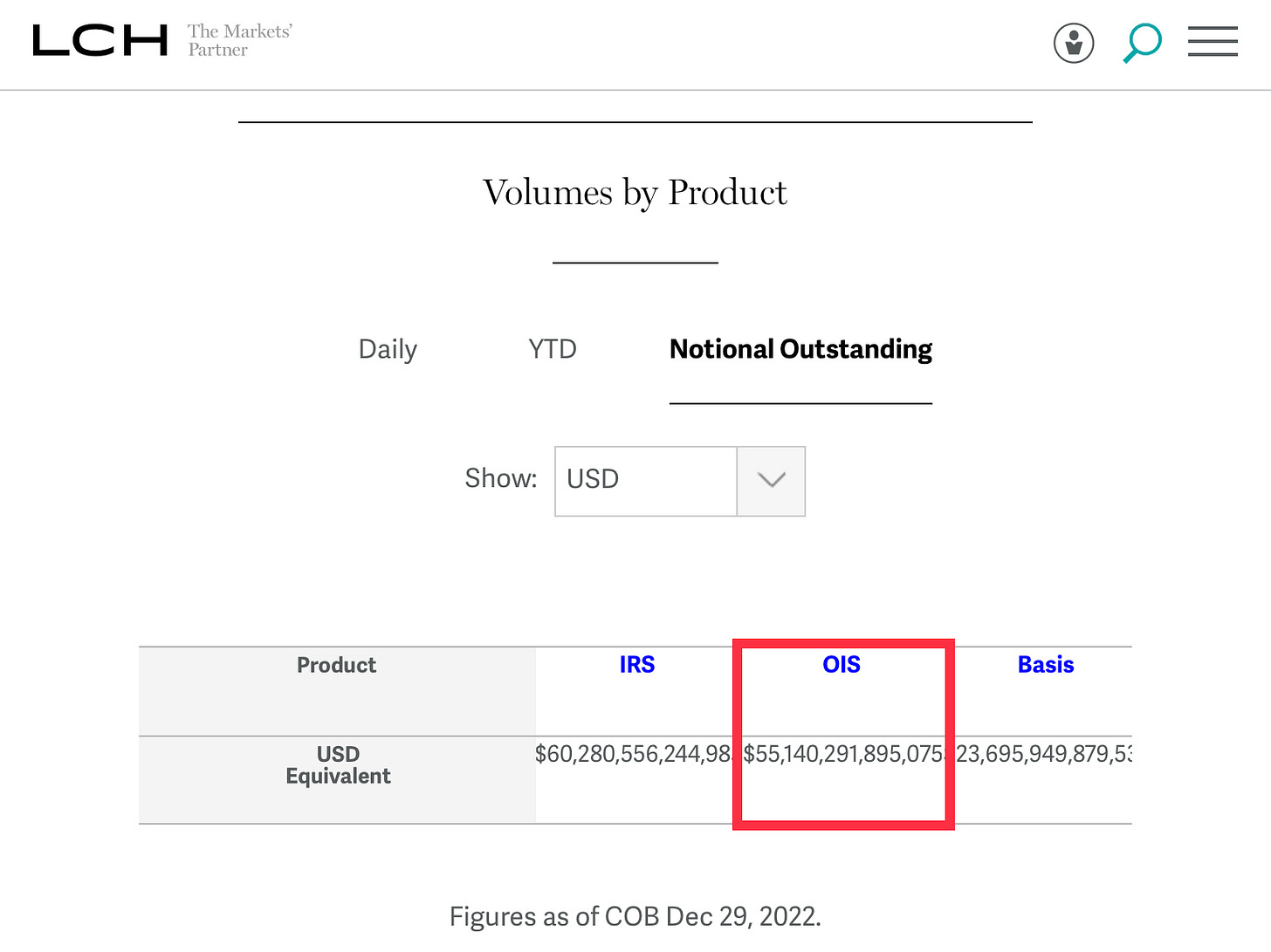

While the notional value of the open interest in Fed Fund Futures markets is currently north of about $500 billion, the vanilla Overnight Indexed Swaps market (OIS) counterparties are currently carrying north of $55 TRILLION in notional risk. In case you’ve never heard of them, LCH Swap Clear in London clears 95% of all vanilla (fixed for floating) interest rate swaps in the world at any given time in all major currencies.

This isn’t intended to be a crash course on the ins and outs of swap markets, but if you aren’t familiar, an interest rate swap is a vehicle to lay off or assume risk whereby counterparties exchange cash flows on any notional value of capital. They are priced based on a fixed rate of interest whereby if one counterparty believes the future rate of interest will be higher than the fixed rate priced for that maturity, they would rather pay the fixed and receive floating rate obviously and will be cash flow positive if that ends up being the case.

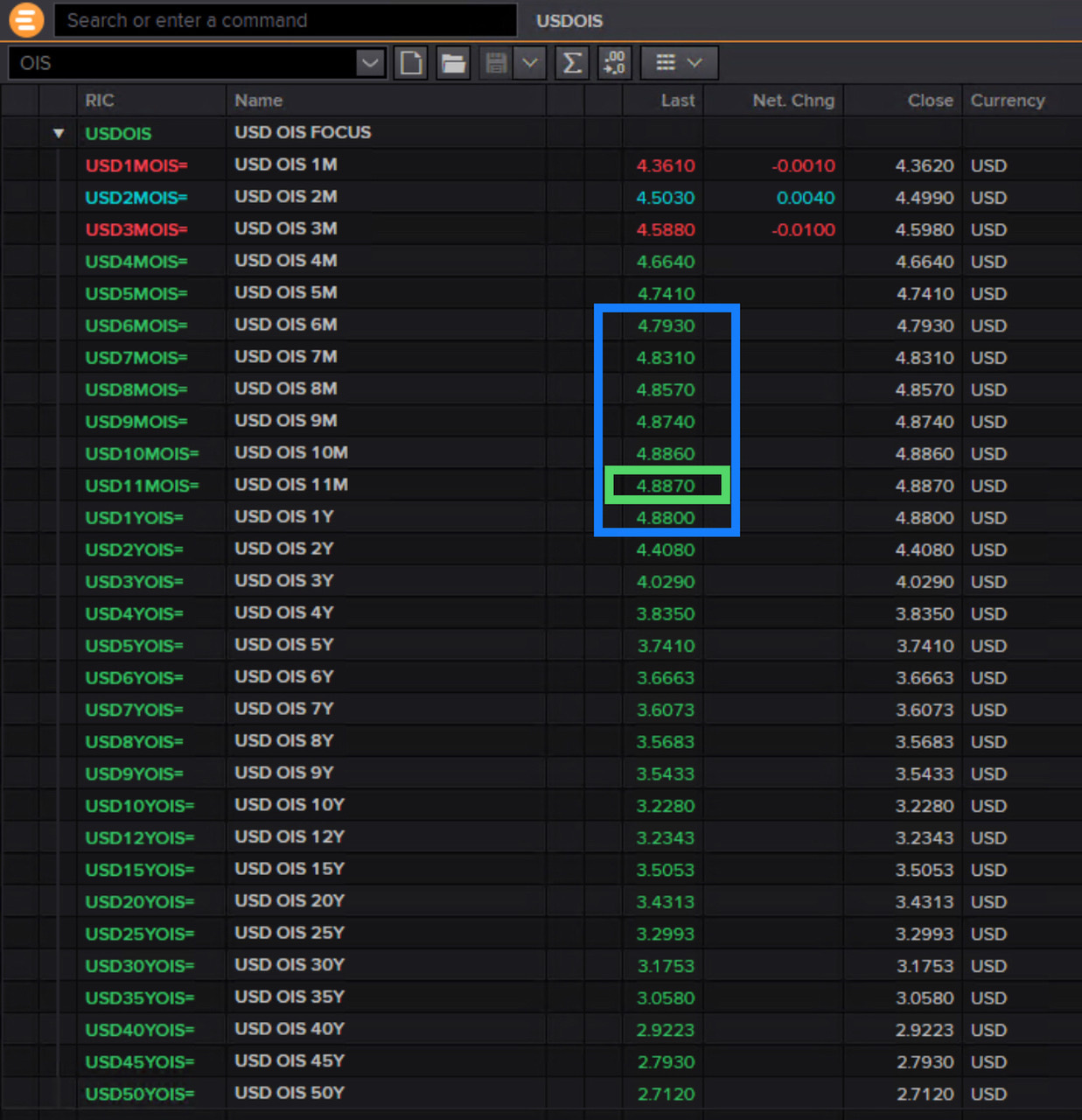

But of course if that doesn’t end up being the case the counterparty on the other side will be the winner so to speak. With so much money at stake from a market purely comprised of sophisticated institutional participants with the most to lose, I tend to lean on OIS swap yields to form my expected key rate opinions a little more than the Fed Fund Futures side of the house.

That said, note the current OIS term structure in the image below price in yield monthly for the first year and then annually thereafter out to 50 years. The good news comparatively speaking is we see these markets are betting on the same 475-500bps terminal Fed Fund rate range, but note the differences comparing to the futures term structure above. The OIS swaps market currently doesn’t expect the terminal range to be reached until as early as JUNE of this year as opposed to APRIL, and expects it to extend potentially as far as JANUARY 2024 as opposed to NOVEMBER 2023.

Food for thought, especially when you see things like this diverge a bit between the futures and swaps markets. I’m sure more uncertainty isn’t what anyone wants to hear right now, but it is what it is.

Obviously all the coming economic data and associated Fed speak can and will alter how these markets price the future of short term yields and likely reactions from all correlated markets. Without a doubt you should be processing all that info as it comes, but as an ongoing “first stop”, watching the STIRs term structures should be a habit as common a breathing for any active trader in my humble opinion. .02