JPMorgan Collar Trade Could Contain S&P Range This Week

Especially as volumes die off into year-end

Follow @MrTopStep and @BretKenwell on Twitter and please share if you find our work valuable.

Our View

I have been paying attention to SpotGamma for over the last two years and for the most part they have been 'spot' on. Consider this:

According to SpotGamma, major resistance remains at 3900, while support can [be] found at 3850, the previously discussed JPMorgan "vol killing" collar at 3835, and eventually 3800. here, SpotGamma remains of the opinion that the S&P holds the 3800-3900 into Friday, 12/30 OPEX, and "for this week, this suggest that SPX moves to either side of this range should mean revert back into the 3835-3850 area.

The most vivid example of the JPM collar in action came just after 10am ET this morning when stocks slumped sharply in a low volume and liquidity air pocket and then stopped the drop just inches away from the 3835 level, before reversing sharply lower.

It's hard to believe the collar will keep things in such a tight trading range, but with the VIX at $21.50, that may end up being the case. Especially on light volume and with many traders and fund managers out of the office for the week.

Lastly, to note:

Beyond December and looking into 2023, SpotGamma believes that January will feature much more relative movement (volatility), as the pin is pulled on the 3835 area with 12/30 expiration (and as the "January effect" is no longer a driver of returns as discussed here). Further, there remains a significant catalyst with the very large equity expiration on January.

Our Lean — Danny’s Take

It's all about the final 3 days and what's left of the tax selling and the end-of-the-year rebalance. The former should finish up today. The latter may go on a bit longer.

I think it's fair to say the ES will continue to struggle as long as the NQ is weak. That was the story yesterday as the S&P tried to push through Friday’s high multiple times, but the lag in tech — with Apple finally making a new 52-week low and TSLA making its 10th straight 52-week low — was an anchor to tech.

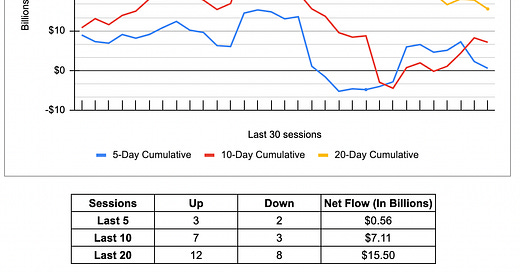

There should be a very high level of 'rotations' like buying bonds and selling S&P or buying Russell / sell tech or some other combination. When the options expire on Friday combined with the rebalance, there should be some very big volume prints. I'm not sure the MIM can beat the DEC quad witchings total $5.6 billion (to buy), but it should be big.

Our Lean: