Follow @MrTopStep and @BretKenwell on Twitter and please share if you find our work valuable.

Don’t Forget: The Long-term performance of the S&P 500, some longer term setups and 5 red flags that showed up before the 2022 bear market.

Our View

Tis the season, right? Well...yes it is, but that doesn't mean you can let your guard down. I know a lot of people like trading right into the end of the year, but if there was any time to slow it down and pick your spots better. There has been a lot of money lost around the holidays and we don't want that.

I remember several years at my S&P desk that some of the accounts would still be pushing the futures around on Christmas Eve. I know some will argue, but all I can say is I have seen this dance and it ruins the holidays and adds undue stress. I would even discourage the customers from trading unless they had to.

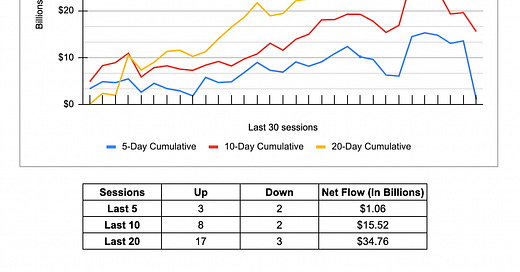

Everyone talks about the Dec Quad Witch and the Fed, but there’s also the PPI report on Friday, the CPI report next Tuesday and the all-important end-of-the-year rebalance (which is usually the last three sessions of the year). This is where huge amounts of money will be moving around.

The moral of the story is, be smart over the next few weeks. It's great if you can scrape some cash-out, but with so little time left in the year, it will be hard to make it back if you’re wrong.

Quote from the PitBull about December:

“Bide your time. Anything can happen. December and January can be squirrely.”

Our Lean — Danny’s Take

Today we will be looking for the Pitbull’s Thursday/Friday low the week before regular expiration (which is next Friday).

Despite the weakness in the NQ yesterday, there was a buyer floating around in the ES nearly all day. Yes, it's oversold, but if the NQ is going down the ES is going to go for the ride too. Let's face it, there is an overload of important events between tomorrow and next Friday.

Our Lean: