The 2000 Tech Bubble vs. Bitcoin: A Floor Trader’s Perspective

How the 2000 dot-com bust relates to Bitcoin today.

If you enjoy this story, please feel free to leave a comment or a “like” at the bottom and please consider sharing it! Thank you - Danny

Before you read this story, it's important to know that the 2000 Tech Bubble was 22 years ago. If you were born in 1990, you were just 10 years old at the time — too young to really know what what was going on, but not too young to know or participate in the cryptocurrency debacle we’re seeing today.

I mention this is because it’s important to remember the history of the markets and avoid repeating its past mistakes.

In 1999 to 2000, tech stocks went up almost everyday. Along with buying and selling the S&P, my desk also did thousands of Nasdaq futures. Back then the pit was only 30 locals and a handful of brokers, and every day the Nasdaq went higher and higher and higher.

We knew that most tech stock valuations didn’t warrant the prices and we also knew it was going to come to a screeching halt — we just didn’t know when. I remember a guy at the desk bought the QQQ late into the rally and he held that position for over 10 years. Even for the best of breed stocks, it took years to recover their value.

Sandals, Shorts and Puka Beads

I remember the days of the tech stock day-trading rooms — leased offices with computers and setups to trade tech stocks — which popped up across the US in 1999. Have you ever heard of those? Not a lot of traders have.

Like the TikTok 'crypto' craze, traders with little to no experience rented trading desks in offices and would show up in the CME elevator banks; they’d show up in the bars and restaurants of the exchange — all over the place — bragging to floor traders about the money they made on “fake” companies.

Of course, these companies existed in the form of stocks, but they weren’t real in a financial sense. No revenue, no cash flows — hell, hardly a balance sheet.

My friend Rob Krilich from Chicago used to brag to me about some kids he knew that were making $50,000 to $150,000 a day buying no-name tech companies that no one had ever heard of. It got so bad that there were even fights that would break out between the floor traders and these young tech stock traders. Most people don’t know this because they weren’t at the exchanges in 1999/2000, but this is the single best comparison to what’s going on in the crypto space today.

The mentality of today’s “crypto bros” is the same mentality we saw from the punks of dot-com yesteryear.

Traders with no experience catching a trading fade that they only knew how to buy (not how to sell and now how to walk away from when the price action turned bearish). They didn’t understand what they were buying because they didn’t care; they had no concept of risk control.

Both sets of traders didn’t care — or think — about the potential losses. They just saw dollar signs and they were chasing them with every penny they had. That’s why we had crypto bros buying mansions in Miami and driving Lamborghinis around town.

Going back 20-something years, I remember talking to this kid wearing shorts, sandals and puka beads at the exchange’s elevator bank. He was bragging about how he bought some tech stock at $6 and sold it for $80 that same day.

A 10-bagger can be had on a good day with some SPX options, but a 13-bagger in the underlying common? Goodness…no wonder these kids thought they could dominate the world!

Later though, I found out the company that this kid was trading was based in a garage in Canton, Ohio.

Like today's cryptocurrency craze, these day-trading tech-stock traders only knew one thing: How to buy…not how to sell.

Many floor traders from the CME were big guys. Some were former football players and they were hired for the floor because of their size — you know, the guys that were 6'2 or 6'4 and 250 lbs. The CME was the floor traders’ turf and none of them wanted to hear some 21-year-old kid wearing shorts and sandals bragging about all the quick money they made.

The CME Merc Club was where many floor traders would go to relax before going back to trade the close. Some went there just to have lunch while others that were having a bad day just wanted a stiff drink. Like the pits, they had their spots at the bar in the Merc club; they knew the waitress and the bartenders by their first name. The last thing they wanted was some kid shooting their mouth off about the quick 8-, 10-, or 20-bagger they just made in some stock — especially if they were already having a bad day.

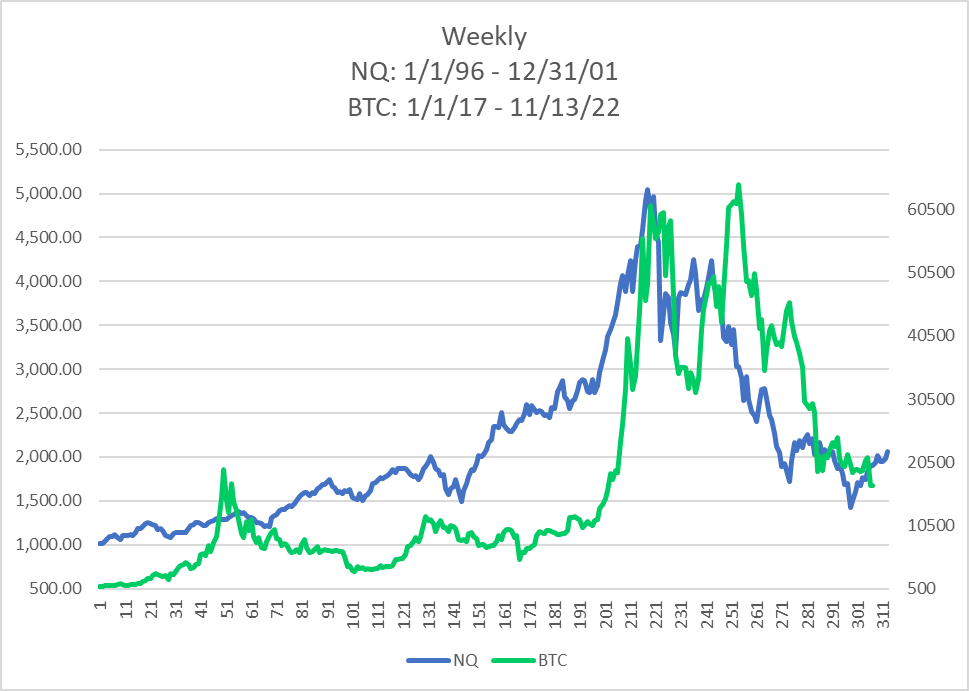

Bitcoin vs. the Dot-Com-Busting Nasdaq

So where am I going with all of this?

It’s funny because history doesn’t always repeat, but it often rhymes. Many of today’s leading tech giants existed during the dot-com bust 22 years ago, but in a much different capacity.

Today' we’re measuring Amazon, Apple and Microsoft with market caps in the trillions. They operate with technology we never even knew was possible and they have become balance-sheet behemoths in the course of two decades.

Despite the decimation we saw in the dot-com bust, we’ve seen the same arrogance and bravado storm into today’s market — but with cryptocurrencies instead of Amazon or Pets.com.

Those same cocky college kids that were riding the elevators in the CME 22 years ago are the same ones we see doing donuts in their Ferrari with “BTCBULL” stamped on the license plate, along with other nonsense.

It’s one thing to ride a trend higher and get off the train before it crashes, but it’s another thing to buy BS assets — if you can even call crypto an asset — and lean on “hope” as the main strategy.

The fallout with FTX is no surprise. In fact, it was only a matter of time before something like this occurred and the domino effect has yet to be felt.

When the dot-com bust was fully underway, the traders wearing flip-flops and getting in fights in Chicago’s finest trading establishments disappeared. They simply vanished! No one ever heard from or saw them again — just like the stocks that they were trading.

And those tech stock day-trading rooms that I mentioned before? Those lease-holders were left as bagholders too.

All of this is to say that, the upswing in crypto looked eerily similar to the rally in the Nasdaq during the dot-com boom and I expect the bust to look quite similar as well.

The moral of the story is know your markets, understand the risk involved and most of all learn how to take a profit.