Tricky Start to the Week as Earnings Start to Hit

The S&P roared higher then whimpered into the close.

Follow @MrTopStep and @BretKenwell on Twitter and please share if you find our work valuable.

For anyone who missed this morning’s guest post, I found it to be a very interesting read. Guest Post: Owning Treasuries While Hedging Against Rate Hikes.

Our View

The ES shook off the two-day 120-point selloff and traded above last week's high. Today's only economic report is the December PMI and MSFT reports after the close.

I want to make myself very clear, I am an equal-opportunity trader. I have been bearish for a very long time and am one of the few people that came into 2022 expecting a large drawdown in the S&P (although I did not expect what ultimately unraveled). That said, I am generally a bull and prefer to be.

But above all, I am an equal-opportunity trader and will play either side. That’s what 30+ years in the pits will ingrain in you. If the ES is going up or down, I want to go for the ride.

One of the top stories in the Wall Street Journal is: Fed Set Course for Milder Interest Rate Rise in February.

The Fed has telegraphed slowing the pace of the rate increases to a more traditional .25 bps. Remember in October when everyone was saying the Fed would overshoot? Since then, Powell has stuck to a hard line that the Fed was not finished with its rate hikes.

The consensus seems to be two more quarter-point hikes and then hold steady. The question is, is it just “two more hikes” and how long will the Fed hold ~5% rates? For what it’s worth, by September the market is pricing in odds for lower rates.

In my view, I don't think the Fed really knows. Just because inflation slowed doesn't mean this is over. And remember how far behind the 8-ball the Fed was when all of this started.

Our Lean

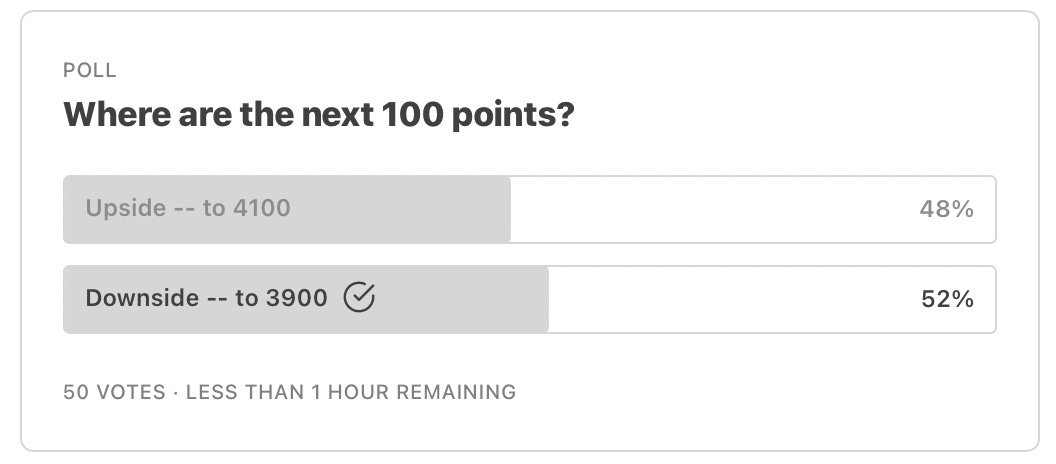

We ran a poll in yesterday’s OP to get an idea on sentiment. So far, the outcome is pretty mixed and slightly favors the bear side of things.

Our Lean: