Guest Post: A Trade on Treasury Spreads

It’s never about what you win...it's about what you don't lose!

We had some favorable responses to a guest post last week, when my friend Rob of the Discovery Trading Group wrote, Sizing Up Fed Policy From a Rates Trader's Perspective.

He’s back again, with the following post. We hope you enjoy it!

Lately, I’m often asked, “Where is the potentially great longer term Treasury curve position trade going forward?”

I certainly don’t have a crystal ball — nor does anyone else for that matter — but I can point out what’s most remarkable big-picture wise and where the biggest payoff will be for those who get it right.

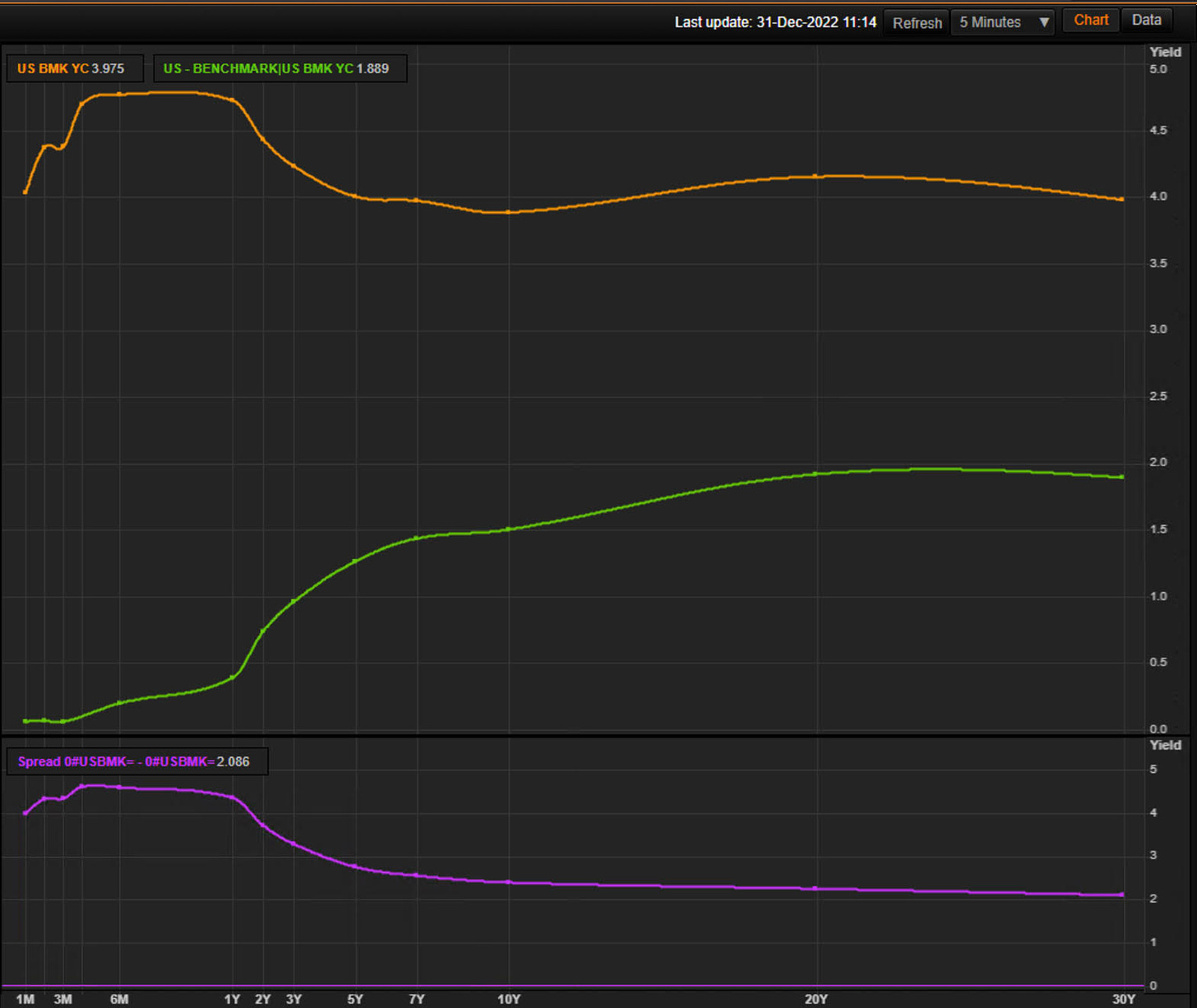

Here’s the US Treasury yield curve I snapped as of the end of 2021 as compared to end of 2022. Obviously we’ve seen the more normal time value of capital slope morph into an extreme front-loaded inversion of yields in response to the steady stream of relatively aggressive Fed policy actions.

Of course at some point in the near future — at least, potentially — a pause in key rate hikes and/or eventual shift into cutting actions will serve to renormalize these curve relationships…

If you’re wanting the most bang for your buck on a longer-term position trade betting on such a renormalization of the curve, you’ve pretty much got exactly two choices: Either sell yields in the front and/or buy yields in the back.

That said, trading your curve bet as a spread IMHO makes the most sense not only risk-wise, but turns a single binary directional bet into a bet on the BASIS between the two chosen legs. Point being you can win from either side or any combination of the two.

As to which legs to choose, the two with most bang for the buck if you’re right will be the ones currently the furthest apart, so to speak, which obviously is the 2-Year against the 10-year.

For those unfamiliar with rates spreader lingo this spread is known as the TUT spread, which is an acronym for the core 2-Year symbol root ‘TU’ against an abbreviation of the 10-Year symbol root ‘TY’ - hence ‘TUT’ spread. Here’s a chart showing the relationship between the two cash yields and how they have progressed into being significantly inverted as a result of the current hike cycle.

Obviously if you’re making a longer term bet on normalization of these two yields, you’d be selling the front yield and buying the back yield.

For most retail traders, making such a bet via cash instruments isn’t an option so you’ll have to do so using the CBOT futures markets. But given these are levered instruments, IMHO making such a long term bet via a single outright futures contract is brave at best and suicidal at worst.

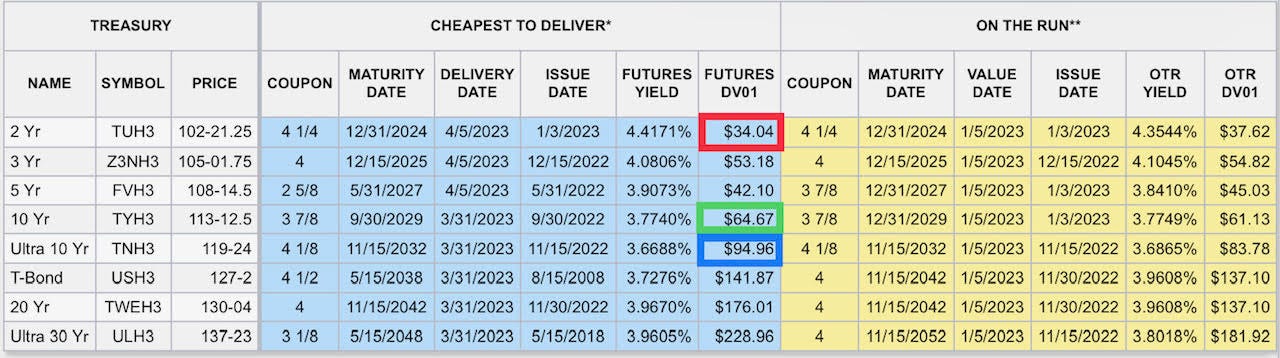

In order to trade them as a spread, you’ll first have to normalize the dollar value of a basis point (DV01) between the legs. You can get the current DV01 values of the cheapest to deliver instrument in the basket daily on the CME’s website under Treasury Analytics.

As you can see in the image below, to normalize the DV01’s between the 2-Year (Globex symbol $ZT) and the classic 10-Year ($ZN), the closest min size ratio will be 2:1. So you’d trade 2x $ZT against 1x $ZN. Many may be unaware that the classic 10-Year contract is generally tracking more like 7-Year paper, so you may instead choose to use the Ultra 10-Year contract ($TN) which is a true 10-Year deliverable tenor and best matched to the cash yields. If so as you can see from the DV01 values you’d use a ratio of 3x $ZT against 1x $TN as the closest min size ratio there.

Remember though, while you’d be forming your overall objectives and timing using the cash yields, the futures contracts are trading in price not yield. As such if you’re wanting to be short 2-Year yield and long 10-Year yield you’ll be BUYING the 2-Year futures leg and SELLING the 10-Year leg, regardless of whether you’re using the Classic or Ultra 10-Year contract.

In closing I suppose the burning question is WHEN will it be the perfect time to put on this trade and/or when will it pay off if I do?

As I hinted at the outset, if it were that easy everyone would be doing it. All I can suggest is pay close attention to upcoming data and associated Fed speak to try to get a sense of when upward key rate pressure will likely be easing and of course try to front run it a bit if you can.

But above all trade SMALL relative to your account size and manage your risk like a hawk. Laying directional risk off by spreading can certainly help, especially on the black swan risk front, but it’s never a magic bullet.

Remember in this game it’s NEVER about what you win. IT’S WHAT YOU DON’T LOSE.